Everything Wrong With The Smartest Guys In The Room is consistently one of the most popular posts every month; according to my statistics, it’s been viewed 51,032 times. But there are errors in it and I see places where I could go into more depth, so I bring you the Expanded and Remixed Version of Everything Wrong With The Smartest Guys In The Room.

The cover:

If you look at the picture, the tag line is “See where all your money went.” This line is just obnoxious, and furthermore, its false: the movie doesn’t demonstrate where the money went. Incidentally, don’t they all three look so young in that picture but especially Fastow? He is practically a fetus in this picture. Now we know him by the steel colored hair, the lines on his face. He must have just joined Enron when that picture was taken. And Jeff is all 1990s corporate hottie with the facial hair. That picture makes me ache.

The opening shot reveals a small church adorned with a neon sign that says ‘Jesus Saves’. The blue-glass and steel Enron tower looms behind it:

A suspicious, grinch-like voice superimposed over this image grumbles, “What’s he building in there?” Then: “What the hell is he building in there?” It is pure mood: all very nefarious, undoubtedly as the brilliant Tom Waits intended when he sang the words, but that said, Waits is not a legitimate critic of Enron. His credentials are about on par with the director’s, Alex Gibney.

John Olson, a man who constructed an entire career of being an Enron skeptic, is the first person to appear on camera. I spoke to Mr. Olson on several occasions while researching my Enron book. Mr. Olson said that Ken Lay killed himself by refusing to take his heart medication. This sort of statement is just appalling, but I think it shows you where this man is coming from.

He says, “It had taken Enron sixteen years to go from about ten billion of assets to sixty-five billion of assets. It took them 24 days to go bankrupt.”

This statement is the foundation for a point that will be illuminated momentarily.

An aerial shot of the Houston skyline appears and the grinch voice asks, “What the hell is he building in there?”

Bill Lerach is identified only as ‘attorney’, which is true, he is an attorney. He is an attorney for a class of Enron plaintiffs. So why didn’t Gibney inform the audience more about this seemingly respected attorney? Wouldn’t someone who wanted a fully informed audience know that this attorney and his firm had finagled billions in settlements? But nothing about the man is assumed in this first shot. Lerach says mildly that, “This company collapsed so quickly and so entirely, I mean, into bankruptcy within a matter of weeks. It just immediately had all the makings of a gigantic scandal.”

So John Olson and Bill Larach, two men with axes to grind, have insinuated that the speed of the collapse indicates “scandal”. Perhaps it was scandalous – just as Bear Stearns’ collapse was, I suppose, scandalous. But it wasn’t criminal.

Amanda Martin, beautiful and blond, says, “The fatal flaw at Enron was… if there was one, you say it was pride. But then it was arrogance, intolerance, greed.”

It should be noted that Ms. Martin has expressed dissatisfaction with the way she is portrayed in this movie, so whatever she says, I’m extra cautious about taking it to heart.

An unidentified man says “It all sort of became smoke and mirrors.” He will show up again later:

Jeff Skilling, his attorney Bruce Hilder, Sharron Watkins and her counsel are shown at the Congressional hearing. There were actually 65 congressional hearings about Enron, but this one was on February 25, 2002.

Skilling was the only executive from the C-Suite who testified. The other executives declined to testify. There is a man behind him in a yellow necktie – he becomes important later.

Bethany McLean makes her grand premiere. She was a cute, mediagenic writer at Fortune whose famous article, ‘Is Enron Overpriced?’ raised alarm bells. Bethany McLean played an enormous role in developing the idea that there was a scandal afoot. But she couldn’t have done it alone. Jim Chanos, a hedge fund manager, had decided in the winter of 2000 to short Enron stock. He then contacted Bethany McLean and told her to look into Enron Corporation, with the understanding that she should find something that would justify his enormous short positions. She wrote Is Enron Overpriced? when the stock was already vulnerable, and though she was not responsible for the collapse of Enron Corporation, she was responsible for creating a series of myths and outright lies that stand today (or they did, until I began fighting them.)

The meat of the story begins with a dramatization of Cliff Baxter’s suicide. A stationary Mercedes-Benz is depicted on a dark street, jazzy music drifting from the open windows. An unseen man inside smokes a cigarette and drinks from a bottle of water. If this is a documentary, why are they showing recreations of Cliff Baxter’s suicide? Documentaries should be about facts. Like Michael Moore’s hit pieces, this is a bizarre effort of mixing fiction with fact. It is also rather tasteless – of all the things to imagine in detail, this is the most obscene.

The voiceover talks about Jeff Skilling and his wife attending the memorial service for Baxter. The correlating images are of the back of a beautiful brunette and a balding middle-age man. The implication is that we are seeing Jeff Skilling and his wife Rebecca Carter. We are not. That is not Jeff Skilling or Rebecca Carter. What else is Alex Gibney, the director, falsely representing?

The focus turns back to the so-called scandal. Rep. Cliff Stearns asks Skilling if before Cliff Baxter died, did Skilling have many conversations with Mr. Baxter. Skilling answers in the affirmative. Stearns asks, “And were any of them relative to Enron?

Skilling looks heartbroken for a moment before he answers yes. He says, “Cliff came over to my house and he says, ‘they’re calling us child molesters. And he says, ‘that will never wash off.’” The grief in his eyes is so naked it is difficult to look at, yet you can not look away.

I’ve filmed it because it’s such an emotional moment (the quality is not great, sorry about that!) but I also wanted to show the screen shot of Skilling’s naked grief:

Stearns says, “Mr. Skilling, you don’t believe that.”

Skilling shoots back with eyes of utter contempt, “I don’t believe what?” Grief turns to indignant defiance.

Stearns says, “You don’t believe the press and everybody calling Cliff Baxter or yourself or anyone on the board of directors denigrating or tainting you, you don’t think it’s accurate. What you are saying to us here today….”

Skilling interrupts Stearn’s rambling monologue. “I do not believe – I did not – do anything that was not in the interest, in all the time I worked for Enron Corporation, that was not in the interest of the shareholders of the company.” His expression is fierce.

Gibney represents that this is the Enron trading floor. This not the Enron trading floor. This was in the new Enron tower that, because of the bankruptcy, was not used. (Later, at his trial, Skilling would testify that after he quit on August 14, 2001 he brought his brother back to the Enron building to the trading floor because he thought it was “so cool”.)

Jeff Skilling endures being told by the Congress that he was the captain of the Titanic, but before it sank, he gave himself and some friends a bonus, then lowered himself and friends to safety. This is egregiously misleading. Skilling did not take any bonus at all. In fact, he was entitled to a huge severance package, which he declined, and he was entitled to another $2 million to repay a loan, but Skilling declined that money too and repaid the loan himself.

Several key personnel were given retention bonuses to keep them onboard. This was not a last minute looting of the treasury as Gibney (and Congress) portray. If bonuses had not been given, every executive would have fled, leaving Enron to sink. At this time, remember, there was still talk that Enron would reorganize around the pipeline business. Bonuses and enticements were a valid and appropriate response to the crisis. Furthermore, there was nothing illegal about these bonuses at all. Had the Task Force reason to believe Skilling or anyone else looted the company, they could have indicted and charged that, insinuating it was hush money. Alas, that never happened.

President Bush appears on screen. Gibney attempts to make it a political issue. If Enron was so close to President Bush, why didn’t the Administration help Enron when Enron was sinking? George Bush says, “If they came to my administration looking for help, they didn’t find it.”

Linda Lay tries to set the record straight about the nickname ‘Kenny Boy.’ “That’s my nickname for my husband,” Mrs. Lay says, “which he [President Bush] overheard.”

Bill Lerach walks with a box of shredded materials. The sticky smile on that man’s face is so self-congratulatory and smarmy it makes Donald Trump look modest. Yet in early 2008, Lerach was sentenced to two years in federal prison for his involvement in a lawsuit kickback scheme. Like his very close personal friend, Bill Clinton, his license to practice law was suspended and disbarment is expected directly. This background becomes relevant very quickly.

Isn’t it convenient that so many media people happened to be there to watch him walk with his box? He says, “This is the shredded evidence we got that came out of Enron.” This is a lie. Enron was never accused of shredding a single document inappropriately. Arthur Andersen was indicted – and later vindicated after a wrongful conviction was overturned 9-0 by the Supreme Court– because of shredding but it was not Enron’s shredding. Whatever was in that box most likely did not come from 1400 Smith Street and was certainly not part of any wrongful shredding.

Even Kurt Eichenwald, author of Conspiracy of Fools and all-around Enron critic, admitted on page 659 of his book, “After several days, the FBI concluded that nothing of value had been destroyed and that – unlike with Andersen – there had been no concerted, illegal effort to shred documents at Enron.”

Like so much that happened in the aftermath of the collapse of Enron, this “shredded box” was just for show.

Back to the Congressional testimony. Question: “Did you convert stock worth sixty six million dollars?”

The camera cuts to Skilling saying, “I don’t know, I don’t have those records with me.”

The Senator says, “Would it surprise you to learn that you did that?”

Skilling replies, “No, it wouldn’t surprise me.” The original question was meant to do imply there was something unseemly about the sales. There was in fact nothing whatsoever improper about them, as the jury in his criminal trial found. But again, the false accusation appears unchallenged in the film.

Lerach appears again to say that there was shock at how much they had profited, a statement that is ridiculous on its face. There was no shock. That was the whole point of Enron: talented people earned lots of money by working there.

The camera then pans to a sweeping Texas oil field. The scene is voiced over with a rant about deregulation, as if it were the very worst thing that could happen because power might fall into the hands of ordinary people.

The Lay-Bush connection is mentioned again. What exactly is wrong with having friends in high places? Especially since, as proven, the friends in high places did nothing whatsoever to intervene in the crisis? But its worse than that. President Clinton, not President Bush, was the primary beneficiary of Enron’s largess. Furthermore, President Bush had been in office for less than a year when Enron went bankrupt and had spent the majority of his fledgling presidency fighting terrorism. President Bush might have known Ken Lay but he was not a friend of Enron. That much should be explicitly clear.

Rich Kinder was president of Enron for a period of time. When he left in 1996, the company put together a video valentine for his send-off. It shows both Bushes saying nice things about him. (It should be noted that Kinder was five years gone when Enron capsized.)

Ken Lay is seen cavorting with multinational businessmen, saying that he wants them all to feel they have been treated with the utmost respect. And you know what? They did feel that way. Not one vendor or Enron customer ever complained on record about Enron.

Jeffrey Skilling is introduced.

“Ken Lay saw Jeff Skilling as what the future is supposed to be.” McLean says, “Jeff Skilling had the biggest ideas of all.”

“Enron would become a kind of stock market for natural gas,” says the voiceover. This is a misrepresentation. Enron was not a trading company – it had a trading arm, but its core business was intermediation. They, like all Enron critics, aim to expand the idea that Enron is a speculative, dangerous, risky company.

Amanda Martin comments on the ‘bigness’ of Jeff’s ideas. Oddly, she is identified in the movie as someone “Jeff hired” and became part of the inner circle. While I suppose that could be literally true, I think it’s a bit misleading. Amanda Martin was an attorney at Vinson and Elkins who handled Enron’s legal affairs. Later, she was brought over to Enron and made president of North American Origination and Finance, where her job was to find financing for power plants. Maybe I’m being too fussy here, but I don’t like the way Gibney is distorting the timeline.

Bethany McLean says that one of the conditions of Skilling’s employment with Enron is that he be allowed to use mark to market accounting. This is disingenuous. Mr. Skilling always thought mark to market a necessity for the companies who did business in the markets he wanted to, and did, create. Mark to market is completely legitimate (it even has the SEC stamp of approval). McLean, however, is insinuating that Skilling had something devious in mind when he suggested mark to market accounting. Though there continues to be a lot of discussion about mark to market accounting, Enron was never accused of abusing the system.

From the same video valentine given to Rich Kinder at his departure, Jeff and other Enron employees spoofed themselves. Skilling here says, “We’re going to move from mark to market accounting to something I call HFV. Hypothetical Future Value.” He laughs because it’s so ridiculous and goes on to say, “If we do that we can add a kazillion dollars to the bottom line.” Throughout, he’s on the verge of cracking up. Jeff is many things but a fine actor, he’s not. I think this is a very important scene. It is actually very revealing about Jeff Skilling. It shows, first of all, that he has a great sense of humor. Later, at his trial, this subject would come up when he uttered the words, “they’re on to us” at a meeting. He said he was joking. Others said he was serious. This scene, where he discusses HFV, shows that he had a great sense of humor and he did like to play.

It also shows that he is incapable of acting. Look at the difference between the youtube video above, and this scene. When he is acting, when he’s saying lines that are not his, he’s stiff. When he’s speaking from the heart, you see that.

Bethany McLean puts on her amateur psychology hat and speculates that, “He really believed that the idea was everything, and when you came up with an idea you should be able to book the profits from that idea right away.” That theory is ridiculous. Jeff wasn’t making money for the company with mere ideas. Actual services and products were being provided to customers who relied on them. In their book – also titled The Smartest Guys In The Room, McLean and Elkind belittle Skilling as being “thrilled” by “the intellectual purity of an idea, not the translation of that idea into reality” (page 28). They then describe him doing just that, i.e. translating such an idea, (ie, the Gas Bank) into reality (pages 33-43). Similarly, on pages 106-108, they suggest that foray into electricity trading badly conceived, then note that by “1998, [Enron] was the biggest power merchant in North America.”

Whatever you think of Jeff Skilling, you can not say that he was an idea man with no follow-through.

The narrator explains mark to market accounting as the “ability to book potential future profits on the very day the deal was signed.” This is true but misleading as presented. In the September 20, 2000 Wall Street Journal article by Jonathan Weil, Mr. Rick Causey, the Chief Accounting Officer of Enron is quoted: “Enron’s unrealized gains don’t depend heavily on gains from long-term contracts that extend beyond the periods for which market quotes are available, reducing the potential for significant earnings revisions. The average length of Enron ’s risk-management contracts is just two years.” So while Enron might have to wait for two years to realize the full value of a specific contract, the portfolio of contracts was constantly maturing, bringing cash in the door. This is significant, but conveniently overlooked by Gibney. Furthermore, to address Ms. McLean’s theory, the contracts that Enron bought and sold were not “ideas”; Enron was not booking gains based on an idea of a contract but an actual contract.

McLean continues, “Because otherwise, some lesser man was taking the profits from the idea that some other man, a greater man [meaning Jeff Skilling] had come up within the past.” Trying to understand McLean’s theory is rather like looking at an Escher drawing – it only makes sense if you’re sleeping. Who is the lesser man? Who would be earning the profits that Skilling’s Enron Wholesale was earning? It is worth noting another inconsistency in Ms. McLean’s theory: mark to market accounting was not Jeff Skilling’s idea. It was developed in the 19th century, long before Jeff Skilling was even born. Furthermore, it was not used in Broadband or for any international assets. It was a limited and completely justified method of accounting which was the only way a complex organization such as Enron would have a meaningful balance sheet.

The next shot is the grinch voice saying, ‘When Jeff Skilling applied to Harvard Business School, a professor asked him if he was smart. He replied, “I’m fucking smart.” And of course he was right. But what are they implying here, that the admittance board of Harvard Business School was in some way in on the conspiracy to promote Skilling through Enron?

“One of his favorite books was The Selfish Gene,” the grinch voice says, “about the ways human nature is steered by greed and competition.”

How does the grinch voice know this is one of Skilling’s favorite books? In all the literature I’ve read about Enron and Jeff Skilling, I’ve never seen this book mentioned. But I guess if it makes good tv, what the heck, put it in there! But let’s take McLean at her word, and assume for the sake of argument that Jeff Skilling was impressed by this serious book which attempts to explain biological imperatives and the instinct to survive (ie, selfishness). But greed is not mentioned in any of the reviews that I’ve read. (Other reviews can be found here, here, here and here.)

Based merely on the reviews, I can argue that the book was not about greed, a word that is a place to retreat for the sloppy and those who would incite. Are McLean, Elkind, and Gibney not “greedy” in their ambition? They made/make/and will make more money than kings and queens in the eyes of more than half the world (and look how they’re doing it). Where does one draw the line between taking care of oneself and one’s family, and one’s employees before it is labeled “greed.” The threesome aren’t wearing rags, giving all their money to charity, or working to help kids in the slums. Who draws the line, Marx, Mother Teressa, Adam Smith?

Sperm are shown swimming merrily across the screen. Are we to assume that Skilling himself contributed to this music video?

“At Enron, Skilling wanted to set free the very instincts of ’survival of the fittest,” the narrator says. Skilling did engineer a competitive, aggressive, energetic culture at Enron, but he was not a mad social scientist trying to force his employees cannibalize themselves.

Bethany McLean says, “Jeff was famous at Enron for saying that money was the only thing that motivated people.” A bag with a money symbol is shown. This bag, apparently, was hidden in the bottom drawer of Skilling’s desk. But I question the premise. Was Jeff really known for that?

When I first read Mrs. Berkowitz’s book, I marked it up with my own comments, and one thing I kept noticing is that none of her sources are named. They are “an executive”, “an EBS employee”, “an Enron employee” but no “Firstname Lastname.” Look for yourself:

That’s just two randomly opened pages. The whole book is full of these anonymous sources. On screen she has Amanda Martin, who is no doubt a legitimate executive at Enron. But nobody else. Why not? If everyone is in the know, if she has all these sources, why not incent them to appear on camera? Instead, all we have is a big bunch of hearsay.

To support the critic’s view that Enron was a self-consuming machine of greed and avarice, Bethany explains the PRC, or the Performance Review Committee, as a humiliating endurance where peers graded each other on their performance. There is some truth to this – the PRC was a real thing- but regardless, there’s nothing inherently wrong with that. As Skilling said, it is an opportunity for employees to get direct communication on their performance from a wider group than just their direct boss. Anyone who hasn’t had a six-month review or an annual review is someone who has never held a 9-5 job. Bethany then goes on to lie that those with the lowest grades were fired, and thus this became known as ‘rank and yank.’ If firings occurred, it was not an institutional mandate.

Jeff Skilling agrees, “Our culture is a tough culture.” But so are any other highly sophisticated companies. Cantor Fitzgerald, Goldman Sachs, Citi, Microsoft are all known to be very aggressive cultures. Nothing wrong with that. They were not, after all, embroidering throw pillows and stitching doilies in those glitzy skyscrapers.

Amanda Martin, ESQ of Vinson and Elkins, says that if you wanted to trade at all, you had to deal with Enron.

Bethany McLean: “The traders were like the super-powerful high school clique that not even the principal dares to reign in.” What high school did Bethany attend? If she’s right, if even Jeff Skilling and Ken Lay were afraid to “reign them in” (I’m not sure they needed to be reigned in, but whatever), then doesn’t that mean that Jeff and Dr. Lay probably were not in on some huge conspiracy? After all, if they can’t control their own traders, how do they control everyone else?

I’m curious – I wonder if Bethany McLean ever set foot on the Enron trading floor while the company was still in business. If this isn’t first-person information about the nature of Enron traders, don’t we, as the audience, have the right to discover the source of this information?

Traders are shown, supposedly being evil as they worked.

Bethany McLean says, “They took Jeff Skilling’s and Ken Lay’s belief in free markets and turned it into an ideology.” What does that even mean? Belief in free markets is something of an ideology, but a successful one, implemented by entrepreneurs and others to direct their business decisions. It’s not a life philosophy, a dogma that must be relentless followed in every aspect of one’s life. Whatever one believes about free-markets and capitalism, one could hardly argue that they were invented by a bunch of 26-year-old traders on the trading floor of the Enron building in 1998.

A clip from an Enron ad for EnronOnline was shown. Jeff Skilling’s voice says, “We are creating an open, transparent marketplace that replaces the dark, blind system that existed.” The images show traders revolting against that dark system.

Skilling continues, “It’s real simple. You turn on your computer, and it’s right there. That’s our vision and we’re trying to change the world.”

They succeeded.

Bethany says, “I think Jeff Skilling had a desperate need to believe that Enron was a success. He identified with Enron. He proclaimed at one point, I am Enron.” While Bethany is telling this story, the very phallic, masculine image of Jeff standing before his building is shown.

But let us examine this accusation, which is quite serious. Are these the words of a businessman or a lunatic? I’d like to know who Mclean claims said that Skilling said “I am Enron” so I can interview him or her. Sound really unlikely. Maybe, at most, he was simply joking. Jeff Skilling was a leader, he inspired people and empowered them. They were Enron. I once described someone as giving others the ‘tools to imagine their own greatness’, which is what I think Jeff Skilling did, and I think he recognized that was his genius.

As the video attempts to get to the heart of Enron, they find people like, Mimi Swartz, introduced as the Executive Editor for Texas Monthly magazine. Swartz says, “The thing about people at Enron is that a lot of them are former nerds, including Jeff Skilling.”

Smartest Guys In The Room co-author Peter Elkind agrees, saying that Skilling had been “paunchy, had big glasses, and was losing his hair.” (“Um… Hi, Pot? This is the Kettle….”)

To address the more serious issue, how would either Swartz or Elkind know that Jeff Skilling was a nerd, or is that merely their own speculation? Is commenting on a person’s appearance a legitimate criticism of their business decisions?

They follow up with a picture of Jeff that shows the big glasses and male pattern baldness. (I suppose he could have found a more stylish frame of glasses, the fucking criminal!)

“And then one day,” Elkind says, “Jeff Skilling woke up and decided to change himself.” The transformation is astonishing.

“He remade himself by sheer will and force of personality,” Elkind says. And it’s true. I love watching people change for the better, and this aspect of Jeff Skilling, this ability to change, is one of his strengths.

Mimi Swartz says that when he got Lasik on his eyes, everyone at Enron got Lasik. I think it proves leadership that a man can inspire a crowd like that, but I too might be wrong to allow the audience to believe the wave of newly glasses-less office was the result of Jeff Skilling. Lasik was a newly available technology at that time and thus Enron employees all had the ability to get the surgery at the same time. Then of course, the camera has to go to an extreme close-up off Jeff Skilling’s newly Lasiked eyes. The fact that the video wastes time on this trivia just shows how weak the ‘real’ evidence must be.

The camera pulls back and Bethany says, “I think Jeff Skilling is really a tragic figure in the classic sense of the word. He’s a guy that people describe as incandescently brilliant. But he is also a guy who is radically different than he, at times, portrays himself. He portrays himself as someone who is tightly controlled but in reality, he’s a gambler,” McLean says. “He gambled away huge sums of money by the time he was twenty years old by making wild bets on the market.”

Huge sums of money? Was Jeff Skilling independently wealthy? McLean says in her book that Skilling grew up in a modest household: “He wasn’t poor the way Ken Lay was poor, but his family lived on the thin line that separates the working class from the middle class. He grew up feeling that he couldn’t ask his parents for money because they didn’t have much.” ( Page 28 ) Two pages later, she identifies the “huge amounts” (i.e., $15,000 he earned from his work since age fourteen at a television station and a $3,500 workers compensation settlement he was awarded after he broke his back while working construction on a toll road in Illinois during one of his summers home from SMU). Assuming these figures are correct, how much could he have really gambled away before his twentieth birthday, considering he presumably used some of this money to pay his own way through college?

And what in the name of cheese whiz does that have to do with him being tightly controlled? Most businessmen are risk takers. Most of them have experience with both failure and success.

Now the movie gets into just making crap up. They show professional dirt bike fiends flying over hills and speeding recklessly around corners, suggesting that Jeff and his crew undertook similar kinds of risks. Again, if this is a documentary, why are they splicing in images that have nothing whatsoever to do with Jeff Skilling or Enron?

Jeff Skilling would take friends and small groups of customers on these adventures, but it’s telling that the director couldn’t produce a single person who was there to describe the events; Gibney at best relied on second-hand information and rumor. The idea that Skilling was doing something above and beyond normal adventure-seeking is just a smear.

Amanda Martin says, “We can speculate what kind of strange insecurities they were trying to overcome, but it made them feel good as men.” Martin is not only an attorney; she also apparently shares a passion for amateur psychology with McLean.

We don’t know what those trips were really like because all we have are a few pictures of fortysomething men looking exhausted after riding dirt bikes. No actual video of the riding is shown in the movie. No-first person account is given. But, even assuming that they were crazy, dangerous, risky, and all-out stupid, so what? Men need to do masculine things sometimes. And I think sometimes, just as people, we need to push ourselves, to go beyond our everyday experience to get to the other side, to know that we can do something amazing. Martin’s comments imply that this kind of behavior was endemic to Skilling who had something to overcome. In reality, Jeff was merely enjoying himself.

Ken Rice got some stitches in his bottom lip on one of these trips. The narrator makes it sound like he nearly died.

“It fed the whole macho culture of the place,” the narrator says. But again, so what? There is an enormous spectrum of personality and character traits between ‘macho’ and ‘criminal’, but this entire segment is meant to subtly tie the two together. And of course they show someone who has probably never heard of Enron as an example of this crazy macho attitude.

The very next picture shows Jeff with his glasses on. Which means it would have been before he got Lasik. But forget about honest chronology.

Bethany McLean says that Jeff Skilling said he liked “guys with spikes”, with something extreme about them. Who and what is she talking about? Extreme? I thought they were all nerds? Ken Lay, was he a “guy with spikes”? Cliff Baxter was way out there; he liked sailing his big boat up and down the Houston ship channel. Woo-hoo!

Bethany McLean takes the screen again to say that Cliff Baxter was very talented but a manic-depressive. I’m not sure how she knows that, unless she simply took his suicide as evidence of it. Her smear rises to the level of libel in this instance.

Lou Pai. Head of EES, Enron Energy Services. The narrator claims that Pai was Skilling’s lieutenant who “dispatched his enemies with incredible skill.” WHAT? Is Jeff now a mafia don and Pai some kind of ninja? What does dispatched mean in this instance? And who was dispatched? Is the originator of that term the narrator himself? The narrator says, “And if that meant leaving bodies behind, Skilling was certainly fine with that.” Jeffrey Skilling’s attorneys should be suing the balls off these filmmakers for this kind of slander. Bodies! I’m agog at the mafia language here. Jeff Skilling was a CEO, not an assassin. I’ve read every page of the indictment and murder was not listed among the charges.

Max Eberts, identified as “former PR for EES (Enron Energy Services)” jumps into the fray and says that Lou Pai was a mysterious figure, “the invisible CEO.” He explains that he would sometimes pass Pai’s glass walled office and Paiwouldn’t be there. All very mysterious! Probably out doing his second job as Chief Ninja.

They then claim that only money and strippers fascinated Pai. Which might be true, but so what? Then it shows strippers, because who can resist putting naked women in a movie about oil and gas intermediation?

The narrator says, bizarrely, that “it was all about the numbers.” You mean strippers can count? But why are they showing strippers? What do they have to do with Lou Pai or the collapse of Enron? Are these the actual strippers Pai supposedly hung out with? Why couldn’t the director find an actual stripper to talk on camera about Lou Pai?

Ebert says that Lou Pai would take the traders to the skinbars and one of the traders said something like, “Lou, how do you keep the scent of the strippers’ perfume off so your wife doesn’t know you’re at the bars?” And Lou replied that he’d stop at the gas station and spill a little petrol on himself to mask the scent. Then the trader said, “But then doesn’t your wife think you’re fucking the gas station attendant?” Then according to the man telling this story, two days later, the guy got sent to Calgary. Ninja powah! Of course the victim in this case was never located – which only goes to show you how deep the conspiracy went. Then to demonstrate the horror of being transferred to Calgary, a man was shown trudging through a blazing blizzard on the sideof the road with a gas can. Is this the victim of the banishment? No? Then why is he in this movie?

The narrative again shifts. Swartz, like McLean, uses the high school analogy, stating that Enron was like high school and everyone wanted to be popular. She then goes on to say that Skilling understood those rules better than anyone. So Jeff is not only a sophisticated conspirator, he’s also stuck in 11th grade. Gotcha.

To the tune of “Lovefool” by the Cardigans, the next segment opens with a mélange of scenes from the NYSE and news anchors gushing over Enron’s market performance.

Amanda Martin, ESQ. comments that all the sudden even people with very little disposable income began to play in the stock market because nobody could fail. It just kept going up, up, up.

John Olson says that Ken Lay was right there acting as a cheerleader, then it cuts to Ken Lay saying, “Obviously our stock has been doing very well and I think there’s a good chance we can see our stock double again over the next year to eighteen months.”

Again, a slew of shots of the NYSE. It’s odd that the video makers put this segment in as it shows that Enron was not the only club in town making money. Unless… you don’t think…. oh my god! Maybe everyone on the NYSE was in on the Enron conspiracy! Alert the media! Call the FBI! I figured it out!

The narrator then claims that Enron mounted a campaign to capture the hearts and minds of stock analysts. I don’t know of a publicly traded company that wishes to anger or disappoint the analysts but I’ve never heard of any organized campaign to entice them into rating them a ’strong buy’ (i.e., that’s called bribery and its illegal. I’m sure the Enron Task Force would have done something about that had there been a scintilla of evidence that Enron engaged in that kind of behavior.)

Amanda Martin, ESQ. explains that the stock price was on a ticker in the elevator, that employees were “surrounded by the health of the company.” She goes on to say that the stock price was an obsession among employees. Why this is shocking to a woman with a law degree and what appears to be forty-something years of life experience under her belt, I haven’t a clue, but apparently it’s slightly nefarious to her that the employees would want a high stock price.

Again that incessant, Love me, love me, say that you love me tune is played over statistics, effectively proving that yes, Enron did list stock on the NYSE.

Lerach joins again and expounds on this mysterious PR campaign while images are flashed to prove that Enron got some ink. He says that Enron was trying to convince the public that they were “heralding a new era.” Which they were.

Ken Lay and a member of the Houston Rockets basketball team say, “Come work for us!”

Jeff Skilling is shown in running togs before a community race. He likes sports, therefore he must be guilty (just ask Ron Artest.)

Ken Lay says, “We encourage people to do new things, try new things, step out.” Then says “We are more comfortable with people who are comfortable in an environment of change.”

The entry at 1400 Smith Street is shown, with the glorious tipped-back E icon. I think they just put this in there because they needed some filler. It really explains nothing other than there was a giant E on the wall, which I covet devoutly.

Jeff Skilling follows up on what Ken Lay said: “When you work for Enron, you’re going to see the newest thinking, the newest markets opening up.”

Swartz says, “They were so good at their acting that they convinced Corporate America that they were smarter than anyone else.”

What a snippy, bitchy attitude. In the first place, their smarts are not in question. If you were secure in your own, you wouldn’t have to put down Jeff Skilling and Dr. Lay. In the second place, they were smarter than everyone else; they were the ones running Enron, they were the ones seeing markets in weather, timber, bandwidth. Where were you? What were you doing? What were you thinking about and working on? I resent the dismissive attitude toward these leaders, and I especially resent the doubt that they could be “no smarter than the rest of us.” What is so threatening about admitting others might be smarter than you?

The narrator says, “Enron was taking enormous risks.” Then Jeffrey Skilling agrees, in this scene saying, “We like risk.” Of course, the video doesn’t allow for the context in which Jeff Skilling said that. Skilling had risk preferences, and would leverage Enron’s competitive advantage to find the risks he liked and that potential and existing investors – e.g. shareholders –would like him liking. He wasn’t just throwing himself at the mercy of the market and hoping things turned out okay. Risk management was an enormous part of Enron’s business, and Skilling’s essentially cautious nature is why he set up hedges in the first place: he didn’t want to play dice with shareholder value.

More scenes of the fake bike jumping crap are shown. The fact that the man is essentially backflipping into a canyon on a motor vehicle tells you that this is where the big accusations start coming in.

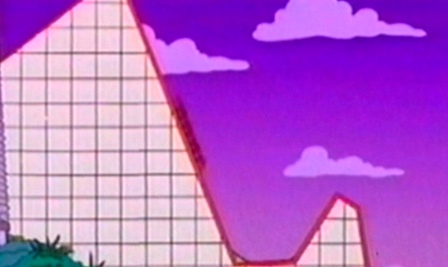

Bethany McLean speaks over a variety of charts showing the general decline of stocks in high tech sectors. She says Enron was a particularly big deal and then says, “Everybody on Wall Street was looking for the Next Big Thing and here you have Enron, which appeared to be a shining star of a company. It’s stock had gone up 90% in the year 2000 and over 50% the year before that.”

Agreed.

Amanda Martin, Esq. says, “We were the poster child of the new economy” while more magazine covers with Jeff’s image sweeps across the screen.

Ken Lay’s warm, sweet, authoritative voice says to his employees, “Well, you’ve done it again. Enron has just been named one of America’s most innovative companies…” And it shows the Fortune article that named Enron as the number one most innovative company in America. The same Fortune that Bethany McLean was writing for – the same Fortune that was apparently fooled by Enron this whole time.

The voiceover says that Enron’s overseas investments were performing horribly, then cuts to Jeff Skilling giving a presentation on Dabhol, a project in India. He says Enron has had a “great quarter and a great year in India. Phase One of Dabhol is in operation, generating power. Phase Two has been financed and is under construction.”

But Enron had failed to see something basic, the grinch voice intones, India couldn’t afford to pay for the power that Enron’s plant produced. “Now, Dabhol is a ruin,” grinch voice says.

This is not true. It is up and running today.

During the trial, several defense witnesses denied outright that there were problems with Dabhol. One of them was Wade Cline, the CEO of Enron India and the CEO and Managing Director of the Dabhol Power Plant. During Ken Lay’s trial, Assistant US Attorney, Kathryn Ruemmler, asked Cline, “Dabhol, in late 2000 and 2001 was a deeply troubled project, was it not?”

Cline answered, “No, ma’am.”

The narrator says: “Though Enron lost a billion dollars on the project, Enron paid out multi-billion dollar bonuses to executives based on imaginary profits that never arrived.” Where did the “billion dollar” figure come from? Fastow is a possibility. From his trial transcript:

Q. And were there discussions about that in these meetings?

A. Yes. I think that’s why we had Dabhol in the troubled asset category or below expectations category in the – for the board meetings.

Q. Were there expectations about the write-down or a write-down that would be coming for Dabhol?

A. Yes. There were — there was a wide range of potential write-downs that people were discussing, but what I took away was likely a write-down ultimately in the $500 million, maybe up to billion-dollar range.

So, a $500 million write-down ‘likely.” I’d like to know if there ever was one, and when.

Bonuses at Enron were not always dependent on profits; they were structured differently in the various units, changed over time, and were based on several criteria. To address the primary point, the local government of Maharashtra refused to honor the contracts in place and pay for the electricity. Lawsuits were in fact initiated to force payment. But it really doesn’t matter. Jeff Skilling was not a fan of third-world investments, and certainly not a fan of Dabhol – and his skepticism of such projects were justified.

Amanda Martin says, “The pressure was enormous to come up with the next new idea. Failure was not an option.”

A news anchor then says, “Enron buys out Portland General.” The voiceover says, “The merger with P&E put Enron in the electricity business.”

The purchase of PGE was initiated in 1996 and completed in 1997. A spot market did not open up in California until 1998. The so-called California power crisis did not happen until 2000. The chronology in the movie is incorrect, and it assigns nefarious motives to Enron when in fact there were none.

Ken Lay says that the merger will allow Enron the opportunity to become the world’s largest marketer of electricity and natural gas at both the wholesale and retail level nationwide. He was, of course, correct.

A PGE lineman says he’d never heard of Enron until Enron bought them. He states that all PGE stock became Enron stock. “I looked around and all the guys around me buying Enron were doubling their money. The whole time I was there, I put in the maximum I could into my 401 and savings.”

Cut to Ken Lay: “Portland General has some good earnings and cash flow.”

Infamous video is played: Skilling and HR executive Cindy Olson speak to employees. Cindy Olson reads a question from the employees that says, “Should we invest all our money in Enron stock?” Cindy’s answer was, “Absolutely!” She turns to Jeff and says, “Don’t you guys agree?” Jeff smiles and nods his head.

Again with the NYSE shots is a news anchor’s voice saying, “Enron is a big winner today!”

Bethany McLean’s voice comes over again, saying, “What fascinated me is that all the analysts had strong buy ratings on the company stock.”

Fascinated? Sure, everyone was fascinated by Enron’s strong performance. But why do I sense something sinister about her fascination?

Sen. Lieberman asks, “Why were the analysts blinded by the company’s deceit?” This is interesting because no trials had been had yet. Nothing at all had happened except Enron’s bankruptcy. There was no proof any deceit, or that anyone was blinded, except for the efforts of Enron demonizers/myth-makers. It’s the same circular reasoning that is the foundation of this music video; first assume there was widespread fraud, then explain how it happened.

An analyst tries to answer by saying, “We relied on the information that was available at the time.” Which was true, they did rely on the information and the information was accurate.

Jeff says, “We’ve been absolutely up front with the analysts.”

Jim Chanos is introduced.

Now this guy, he’s a piece of work. He says here, “Jeff Skilling was the critical component of creating the Enron illusion.” Consider the source. Jim Chanos is a notorious short seller. In other words, he makes his money when a company’s stock declines, and he made a mudslide of money on Enron’s failure. He is the person who fed Bethany McLean the first nibblets of suspicion that Enron wasn’t as strong as it appeared because he was attacking the stock. In February 2001 he had a meeting of a group called Bears in Hibernation, a group whose agenda is exclusively devoted to deciding which stocks to attack. Enron was the stock they chose. Jim Chanos is the last person whose opinion about Enron you should take at face value. Peripherally, like Lerach, his ethics are questionable, though for different reasons: Chanos was connected to the hooker that serviced Gov. Spitzer and eventually caused his political downfall.

The narrator says that when analysts called Skilling, they were willing to believe anything he told them. How this relates to Chanos’s theory of an “illusion” is mysterious since it assumes that analysts were unable to think for themselves. Analysts, it should be noted, were extremely sophisticated and from companies like SmithBarney, Goldman Sachs, and others. Why were they willing to take Skilling’s word and no other CEO’s? The answer: they didn’t. They too looked at the 10K and Q filings, and the many other public filings. They talked to the Enron people on the phone and in person. They attended analyst conferences, and participated in earnings release calls four times per year. Additionally, the analysts did their own industry and company-specific research. They were not imbeciles, blindly taking Skilling’s dictation. They reported accurately that Enron was booming.

Then, without any support or documentation whatsoever, the narrator says, “Any analyst who didn’t buy the company line became an enemy of Enron.” Oh really? Why didn’t they go to the SEC and complain? Why didn’t they go to their bosses at Merrill Lynch, Smith Barney, Citi, First Boston, Credit Suisse, and Deutche Bank and complain that they couldn’t get any real information from Enron? Not a peep, not a word.

“CFO Andy Fastow had his eye on John Olson,” says the narrator. “One of the only analysts skeptical of the Enron story.”

Then it cuts to John Olson saying, “Enron loved analysts’ strong recommendations.” Well what company, pray tell, doesn’t? But don’t let critical thinking get in the way, there’s a witch hunt on!

Olson, then an analyst with Merrill Lynch, claimed that Andrew Fastow called Merrill and told them that ‘you either get somebody on board with us or we’ll take our business elsewhere.”

Olson, like Chanos, is not a particularly credible witness. Would he admit he was a not the smartest analyst on the street and perhaps didn’t understand Enron? He didn’t know what happened inside Enron, and of course Gibney doesn’t put up anyone that might suggest that there was another side to this story.

Merrill fired Olson, and “soon after, Fastow rewarded the bank with two investment banking jobs worth fifty million dollars.”

Fastow might have had the authority to steer business to specific banks, but I think calling this a “reward” for firing an analyst is a little extreme, and extreme speculation. Is John Olson’s word really worth fifty million dollars?

The narrator then shifts gears again and says that Skilling decided to take Enron into cyberspace. Again, the chronology is wrong and this isn’t exactly true anyway. Skilling at first was not convinced it was a good idea to but the platform online. At trial, he said, “I was not a big fan of these electronic trading platforms. I — I didn’t think it was a good idea, and I think you can spend a lot of money on it with no return.”

An ambitious woman in the London office named Louise Kitchen actually assembled a small group who worked on the platform for over six months. John Sherriff, who was the head of the office in London, flew to Houston and presented it to Skilling. He asked, “What do you think?” After further consideration of the more developed idea, Skilling was sold. “Good,” Sherriff said, “because we’re rolling it out in six weeks.” (More on EnronOnline here.)

Ken Rice, of the busted lip fame, was the head of the group that would now trade bandwidth on the internet like energy or pork bellies. “Enron has found a way to stay ahead of the curve,” Rice says.

A few people have told me that Ken Rice was not well suited to his role of co-CEO of Enron Broadband Services. Every person I spoke to has said the same thing: He wasn’t really cut out for that position, though they never saw him do anything criminal.

In 1999, after years of preparation, Enron unveiled its Enron Broadband Services division. It was a major focus of the annual conference Enron hosted for securities analysts on January 20, 2000. The reception to this was so great that on January 20, 2000, the stock bounced from $54 to $67.

Later, this conference would become key to the case against the Broadband Three. Prosecutors allege that they lied at the conference to inflate the stock. This is not true. One of the Three, Rex Shelby, had never sold or bought any stock before this date. He was a complete novice, and he sold on the advice of his friend who was a little more sophisticated in these matters.

(For more about the conference and the allegations against the Broadband Three, click here)

In July 2000 Enron announced a deal with Blockbuster to deliver video on demand. Prudential analyst Carol Coale says, “It was like being at a religious cult meeting.”

Coale seems to be talking about the January 2001 conference, not the Blockbuster deal from six months earlier. But Gibney conflates the two events. Blockbuster was not EBS. It was just a part, and a relatively small and transitory one at that, of a much bigger business. Enron explained it well, and was putting that business in to action. The analysts understood that. But Gibney/McLean/Elkind don’t, or no doubt more accurately, don’t want to, instead choosing to mis-describe it so it fits their bogus storyline. Nobody has challenged them about this.

The narrator claims that one analyst (unnamed) summed up his recommendation to his investors in one word: wow.

Enron stock soared 34% in two days.

“You can tell from the response from the stock market that they like the strategy. It makes sense,” Skilling said.

The technology, says the grinch voice, didn’t work and the deal with Blockbuster soon collapsed.

That’s not true, but tough to prove. The first EBS trial – in which the Task Force tried to prove the technology didn’t work — ended in disaster for the Task Force. One source for some interesting information is this Houston Chronicle article about an engineer’s testimony about the software. Lawrence Ciscon, Enron Broadband Services’ former leading software engineer testified that the network operating software that prosecutors disparaged really did exist, was being phased in on schedule and has since been patented. He also reports that he felt threatened by the Task Force, but that’s peripheral to this discussion. And Ciscon wasn’t alone: many of the engineers who worked on the technology testified that it did indeed exist. At the trial of the Broadband Three, one of the defense witnesses who actually coded the software was on the stand. Rex Shelby’s attorney, Ed Tomko, tried to admit the software into evidence but Judge Vanessa Gilmore would not allow it, saying that the code would be unintelligible to the jury. The programmer was ready, willing, and able to walk the jury through the code line by line but was unable to. This is a travesty of justice.

Furthermore, the government seized the software and all servers during the investigation and basically “lost” all the important defense evidence.

Of course, the movie was made before the trial so they could have known none of this. But they could have known that there was another side to this story – such as the fact that the software did in fact work; it had been used to stream a tennis event, the Country Music Awards, and some other events. That is a fact. Intelligent, honest people can argue over the question: When is software complete? but there is no doubt at all that the software did exist and was working. (Incidentally, Rex Shelby said on the stand that “software is not complete until it’s obsolete” (meaning, you keep refining software forever).

Bethany McLean: “By the end of 2000 Enron was running out of ways to make the Broadband business look successful. They’d tried every trick in the bag to try to create the illusion of a business where there was none and the people who were working there were getting increasingly desperate.”

McLean was wrong. EBS was still doing well then; the bottom didn’t start falling out until end of February and March, and if Enron hadn’t gone bankrupt would no doubt be hugely successful today (though this is an example why Enron such an easy target, given that because we never got a chance to see what would have happened folks can say almost anything and can’t be absolutely proven wrong.)

The voiceover claims, “The executives started selling their stock.” He lists the figures:

“Ken Rice had sold 53 million, Ken Lay had sold 300 million, Cliff Baxter, 35 million, Jeff Skilling, 200 million.”

How accurate are these numbers? For example, Skilling was asked about a sale of $66 million during his congressional hearing. Are we to assume that the congressional questioners didn’t care about another $134 million? The discrepancy can’t be overlooked, but was but untrustworthy Gibney.

In any event, the innuendo is hugely suspect. Again, let’s take Skilling. He periodically sold some of his constantly growing Enron stock positions. But he didn’t dump stock and run. He held onto massive amounts of stock right up to the bankruptcy and after (as he proved at trial, at the time he left Enron, he was a net investor in Enron and had more stock when he left than while he worked there). Like so many others, he too lost millions when Enron collapsed. If he were truly as greedy as his critics would haveyou believe, he would have maximized every bloody dollar.

It’s also worthy to note that in 1997 when Skilling became president of Enron Corporation, he left close to $50 million dollars on the table that he was entitled to. When he started the Wholesale operation, he was given an equity stake. When he became President of Enron Corporation in 1997, it was decided that he would switch into Enron stock and options (in other words, the interest he had in Wholesale was cashed out in the form of Enron stock and options.) Mr. Skilling decided, of his own free will, not to take all the money that he was entitled to under the cashout formula. During the trial he said, “I didn’t think it was reasonable to hold the company to that formula, because ECT had been so successful that the numbers were — were pretty large. And, so, I just — I agreed to a much lower payout.”

He was entitled to $70 million. Instead of the full amount, he took $21.5 million, leaving close to 50 million dollars on the table that was rightfully his. Does this sound like the actions of a man consumed with greed? Can you honestly say that you’d leave that money on the table for your employer?

Chanos says, “The fraud is the reality.” No fraud has yet even been mentioned in this movie. Not one thing has been proved or even, come to think of it, alleged. All that has been insinuated is that Jeff Skilling was a nerd who turned himself into a handsome corporate superstar, that lots of money flowed through the building, and that Lou Pai liked his women trashy.

Again, that thought isn’t complete or explored before the director jumps to a new subject.

A person asks Jeff Skilling how the new weather trading is going. Skilling explains to the audience, “We have a market in weather.”

The narrator mocks him: “When Enron announced its latest plan to trade weather, people wondered whether it was good science or science fiction.”

Here’s the answer: good science. While they were never a big deal to Enron’s bottom line, weather derivatives were a complete success. They are traded today.

A reporter walking with Jeff through the office, asks, “Do the weather guys get punished here if the weather is wrong?” The reporter’s question is completely meaningless, as either he was joking and having fun or he didn’t understand the product. Gibney exploits this, and the expected ignorance of the audience and reviewers of his cartoon. Jeff playfully leans over to a guy in a cube and says, “You have whip marks there on your back, Mike.”

Amanda Martin, Esq says, “Jeff, as time went on, had a harder time admitting things were wrong. And I have to believe that when the lights went out at night, he knew what was coming.” What exactly was wrong? What indication did he have that things were wrong? What is the basis for Martin saying this?

Then the director splices in some ridiculous footage of a basejumping guy to illustrate this false point.

Bethany McLean admits that Chanos contacted her and told her to look into Enron’s financials. McLean claims she poured through Enron’s financial statements but it wasn’t clear that there was fraud here. ‘But it was clear that something didn’t add up.”

What didn’t add up? It’s not revealed in this music video.

Rep. Henry Waxman (D-CA) says, “Bethany McLean, a reporter from Fortune magazine first raised questions about Enron’s financial condition.”

That’s not exactly true. The first article to raise “questions” about Enron’s mark to market accounting was Jonathan Weilin a September 20, 2000 Wall Street Journal article. It is also worth noting that the questions Weil raised had Enron-friendly answers.

Bethany McLean’s Fortune article, Is Enron Overpriced? followed on March 5, 2001. But McLean doesn’t bother to clear up the record, and again, that false statement makes it into the movie.

Waxman continued: “She asked a simple question that nobody could seem to answer. How exactly does Enron make its money?”

Nobody could seem to answer it? Jeff Skilling answered it over and over again, so did Rick Causey, Ken Lay, Mark Palmer (PR person, not the Mark Palmer in EBS), and an entire corps of public relations people. So to whom is he referring? McLean? Himself?

Skilling responds, “I very specifically remember the conversation that I had with the Fortune reporter. She called up and started asking some very, very specific questions about the accounting treatment on things. I am not an accountant.”

Bethany then interjects: “Jeff became very agitated and said that people who ask questions are just trying to throw rocks at the company and that I was not ethical because I hadn’t done enough homework.”

Waxman says it sounds like Skilling is bullying her.

Skilling responds, “I said to her I have six minutes before I have to be in a meeting and I can’t get into the details and I’m not an accountant. And she said ‘well that’s fine, we’re going to do the article anyway. And I [Skilling] said that if you do that, I personally think that’s unethical.” He then explains that Enron executives flew to New York to sit down, not withthe editors but with the reporter herself to discuss Enron’s accounting to help her understand the questions she was asking.

“And the next day we sat in this small, dark, windowless conference room for about three hours,” McLean says. It was her office. Ostensibly she could have found a better conference room. She goes on to say that when the meeting was over, the other two executives packed up their things and left the room but Andy Fastowturned around and said, “I don’t care what you write about the company, just don’t make me look bad.” It’s telling that McLean doesn’t reveal what they actually did talk about at her meeting with Andrew Fastow, Mark Palmer, and Mark Koenig. Did she understand what she was told? Bet not.

Grinch voice comes in and says, “And Fastow had good reasons for not wanting to look bad.”

Bethany McLean mentions the partnerships that Fastow set up. Then it cuts to her article that ran.

Skilling talked to his employees about the article. He says the gist is that Enron is sort of a black box. He holds up his hands and says, “Sorry, it’s true. It’s just difficult for us to show how money flows through, particularly, the wholesale business.” Skilling explains that the reason for the article is because Business Week had a favorable article the previous week. Enron was essentially a source of competition between the two publications.

A new segment begins with a picture of Andy Fastow. He looks typically Enron: sporty, handsome, accomplished, even while wearing a baseball cap and a t-shirt with the mascot of his son’s little leaguge team.

The narrator says, “Andrew Fastow. His job was to cover up the fact that Enron was becoming a financial fantasy land.” What? Fastow created the partnerships that later came under such criticism, which, ironically, for the most part were good for Enron, its shareholders and its customers. His job was to secure financing for Enron, which he apparently did very well.

Peter Elkindsays that Enron is hemorrhaging money yet documenting positive income on its financial statements. “The way to do that is structured finance,” he says.

Wait just a minute there, Boss. Structured finance involves real negotiations between real parties that create real rights and obligations that justify the accounting treatment as both a matter of form and substance. Saying ’structured finance’ has become something like saying ‘abracadabra’ — a spell is cast and all ability to understand and think critically is lost.

Sharron Watkins makes a re-appearance. She says that Fastow idolized Jeff Skilling.

Grinch voice says that to please the boss, Andy had to find a way to keep the stock price up while the company was 30 billion dollars in debt. We never hear in this music video what Andy did in this regard; how was Andrew Fastow responsible for keeping the stock price up? The grinch misses a key point here. He should not have said, “30 billion dollars in debt” – even assuming that was the right number — but that Enron “had $30 billion of debt.” The fact Enron had debt was no secret. Every large company has billions of dollars of debt. More importantly, Enron was solvent, and was solvent when it went bankrupt.

“It was black magic,” Lerach says. How clever.

While Fastow is shown giving a presentation, Sharron Watkins says, “Andy, we all knew, didn’t have a strong moral compass.” Yet she never saw fit to report her boss to Skilling or Ken Lay, or even utter her suspicions to others.

She then says, “It’s almost as if Jeff Skilling set up Andy.” And of course a nefarious overlay of Skilling’s image comes up over Andy’s presentation.

Sharron says, “There is a Body Heat element to this where Skilling is Kathleen Turner and Fastow is William Hurt.” That’s just a … wow… That analogy is …. fun. She goes on to say, “In the end, he got suckered into helping all the executives meet their earnings.” Again, why is Andy the victim here? But a larger point should be made that it is the entire purpose of a company: to meet goals.

Jeff Skilling appears before the panel again. He says, “In retrospect, I wish I never heard of LJM.”

Asked if it was his contention that he had heard of LJM and thought it was appropriate, Skilling replies, “Arthur Andersen and our lawyers had taken a very hard look at the structure and believed it was appropriate.”

The Enron board signed off on all the partnerships and the deals.

Andy Fastow is shown talking to some Merrill bankers about a deal.

Grinch voice intones that both Arthur Andersen and Vinson & Elkins were making money from Enron. Amanda Martin says, “They all had their hands out at the table.”

Counselor Martin seems to be ignorant of the fact that business-to-business is a legitimate way to earn money. This section is to imply that there was a multi-business conspiracy going on, a willingness for support companies to accept Enron’s ‘fraudulent’ activities because they were being paid.

Several images of a Senatorial investigation flash across the screen, ending with Carl Levin accusing Merrill Lynch of an improper Nigerian Barge Deal. The segment ends with innuendo and rumor. The postscript to that, of course, is that the people involved in the Nigerian Barge Deal have largely been exonerated.

Bethany McLean’s voice is superimposed over an image of Skilling. She says, “Over the year 2001, Skilling became increasingly despondent. He’d always been a moody guy, but people who knew him said he became increasingly volatile, showing up for work unshaven, looking blurry-eyed. I think it was the battle of holding these two totally disjointed thoughts in his mind at the same time.”

Then it goes back to Bethany to allow her to explain what Jeff Skilling was thinking: “One [thought] is Enron is a superstar company and the other of feeling like it was all crumbling away.”

Who are these “people who knew him”? Where are they? Give me some names so I can interview them. I’ve spoken to many “people who knew him” and they don’t use words like “moody”, “volatile”, “unshaven” or “blurry-eyed”.

Secondly, it appears true that he was becoming irritated with work. He has said innumerable times that he was just plain tired. He had given more than 10 years to Enron as an employee, and many more before that while he was with McKinsey& Co. as a consultant to Enron, and he was growing tired of the demands placed on him. He wanted to spend more time with his family. Accepting Bethany’s statement does not prove any sort of conspiracy. It proves he was tired.

The voiceover says, “The first cracks in Skilling’s public image appeared in a conference call with analysts in April, 2001.” More specifically, it was one of four quarterly conference calls related to Enron’s release of information about its earnings.

Short seller Jim Chanos appears to explain that, “Skilling took questions. And about midway through the session, there was a question that was aggressively wondering out loud, why it was that Enron, as a financial services company in effect could not release a balance sheet with its earning statement like most financial institutions do….”And quite audibly you could hear Skilling say, Asshole.”

Which was true. Here’s some context: Analyst, Richard Grubman, a short seller who may or may not be one of Chanos’ goons from his Bears in Hibernation, had asked Jeff Skillingin the past to issue the balance sheet with the earnings release. Skilling had explained that the balance sheet is not issued with the earnings since the two sets of data, earnings on the one hand and the balance sheet on the other, were prepared at different times out of necessity.

Transcript from the first of the two calls in which he asked the same question:

For example, in earnings release conference call, held January 22, 2001;

Richard Grubman: I was wondering if you could tell us what assets and liabilities from price risk management activities were at year end, both current and non-current, so those four balance amounts. Thank you.

Jeff Skilling: I don’t have that information with me.

Paula Reiker: The question had to do with price risk management and that comes out with the balance sheet, which will be disclosed in our 10K. In terms of impact on overall cash flow, we would expect, you know, for the full year 2000 that earnings would roughly equal cash flow.

Richard Grubman: I guess I don’t understand why we can’t get sort of seminal balance sheet data now.

Mark Koenig: Well – this is Mark Koenig. And Rick Causey is here, our accountant. We have not finalized all of the balance sheet data and we’ll disclose that as we put that together with the associated notes that are important to accompany that [the 10-Q]. That’s the reason.

Grubman: OK. Thank you.

The second conference, in which the same question was asked yet again, Skilling lost his cool and called the guy an asshole.

Nevermind that his rude word is not illegal or in this instance particularly improper, the camera guzzles up images of people discussing the ‘Asshole’ comment, specifically Waxman saying, “And as I understand it, you called the guy an asshole.”

Skilling is composed as ever but the guy to his right is cracking up. The man to Skilling’s right, though, is an interesting story in itself. He was counsel for certain plaintiffs who’d already sued Enron civilly at the time. In other words, he was a plant. He was put there to makes faces and belittle Skilling on national TV, and apparently in partial reruns like the ones used in this music video.

Bethany McLean says, “And this just caused unbelievable amounts of consternation all across Wall Street because people thought, ‘a Fortune 500 CEO losing it like this? Publicly calling an investor an asshole?”

Skilling replies, “If I could go back and redo things, I would not, now have used the term that I used.”

The plant-guy to his right laughs again:

Cut to Bethany McLean saying, “Mark Palmer, Enron’s chief PR guy even ran a note up to Skilling telling him to apologize and he just took the piece of paper and tucked it under the pile of papers on his desk. Afterward, Enron’s traders who had erupted into cheers when Skilling called this guy an asshole made him a sign. It was a play off Enron’s motto, Ask Why.”

Amanda Martin, ESQ. takes to the screen again and says, “My personal feeling is that Jeff looked at the numbers and he knew that we were in a massive hole.” Jeff Skilling was CEO. He looked at numbers every single day. It wasn’t as if he woke up one day and asked, Where am I? What are these numbers? Why am I sitting behind this large office behind a custom-made desk with a panoramic view of Houston? He had been there every step of the way, and if we remember what Bethany McLean said about his insistence on using mart to market accounting before he would agree to work for Enron, we also know that he had built up the entire Wholesale operation at Enron. No doubt, Skilling’s only sense of surprise came much later, when the company collapsed.

Shot of Jeff while Amanda continues, “It was the only time I saw him truly, truly worried about keeping the stock price up and he just kept saying to me, ‘I don’t know what the hell I’m going to do.’” Really? When did this ‘only time’ happen? Might this be an example of the rumored taking out of context of what Ms. Martin said?

Peter Elkind appears onscreen again to say that the Broadband business was in meltdown as Jeff, as Chief Operating Officer, was in his office when Ken Lay came in with swatches of fabric for the new G5, 45 million dollar corporate jet Ken wanted to buy. To me, this speaks to Dr. Lay’s and Mr. Skilling’s honesty when they said that Enron was in strong financial shape.

Furthermore, Jeff Skilling was promoted to CEO on February 12, 2001. If Skilling were still COO, this incident would have been before the ‘asshole’ comment, so this entire ’story’ is completely taken out of sequence, much less context. Secondly, where did this story come from? One can safely assume Elkind wasn’t in Jeff’s office when this incident happened. How does he know this happened? Why couldn’t they produce the person who actually was in Skilling’s office when this event ostensibly occurred? Or is just so much Enron rumor that continues to live on as truth?

The narrative then does a crazy jump, which is consistent with Gibney’s apparent inability to tell time. One needs to take things out of sequence to distort and avoid the true story, I suppose, and this a quick and easy way to do it. Art, comrade, Art!

Max Eberts is introduced as ‘Former- PR at EES (Enron Energy Services)’. Yet no title is attributed to him, no dates of his employment at Enron. Technically, he could have been a one-semester intern, and we’d not know it from this video. But his word is taken for the gospel when he says that during the quarter there was always this impression that Enron wouldn’t make its numbers, but somehow, oddly, Enron always came through. Then one day, somebody (again, the unnamed ’somebody’) asked Tom White, Lou Pai’s second-in-command, how they made their numbers and White’s reply was one word: California.

It opens with that OC song, ‘California… here we come… California….’ and as fitting this music video, there are some nice stock images of Cali.

The narrator says, “The first clues to Enron’s new strategy hit California with a jolt.”

NEW? What? What is this guy even talking about? If it was new, then the Max Eberts was mistaken when he said that Enron “always” made their numbers on California? But it’s a lie either way. California was a troubled market, similar to Cuiba and Dabhol.

Now we’re into one of the most controversial areas of Enron, and one of the most misunderstood. Before this goes too far, let’s just immediately skip to the court transcript and find out what Jeff had to say about California:

(From Jeff Skilling’s cross examination. Questions are from Mr. Sean Berkowitz.)

Q. All of those risks [regulations in foreign countries] that are separate and apart from risks that you’d have if you invested the money here, correct?

A. Unless you’re in California.

Q. We’ll talk about California

A. Okay.

Q. Do you think that’s funny? You were smiling. “Unless you’re in California”?

A. I think the –

Q. What happened out there, do you think that was funny?

A. I think the regulatory environment in California was not at all dissimilar to the regulatory environment in Brazil. In fact, they were very similar.

Q. You previously made fun of what happened in California, right, Mr. Skilling?

A. I think probably fair to say that I felt the State of California was unfairly targeting Enron.

Q. And you publicly made jokes about the situation out there, didn’t you?

A. A joke, yes.

Q. And you regret that now?

A. I think — you know the situation behind that. You know the situation that was going on.

Q. Do you regret making that joke about what happened in California now, Mr. Skilling?

A. Yes, now I do.

Q. All right. To get back to international assets.

In Skilling’s congressional testimony, he explained, “As far as the joke related to the Titanic, all I can say is that was at a time of very, very frayed tempers as a result of the situation that was going on in the state of California. One week prior to that meeting in Las Vegas, where I made that statement, the highest law official in the state of California, Attorney General Bill Lockyer said – and let me quote – “I would love to personally escort Ken Lay to an eight-by-ten cell that he could share witha tattooed dude who says, quote, ‘Hi, my name is Spike, honey.’

“That was May 22, 2001. That was the kind of stuff going on. Can you imagine what tempers were like? I know Mr. Lay. I’ve worked with Mr. Lay for a long time. Mr. Lay doesn’t deserve prison rape or the suggestion by the top law enforcement official in the state of California that he be raped in prison when he hadn’t been charged with anything and hadn’t been found guilty of any issue.”

Let’s get back to debunking this music video posing as a serious documentary.

Three minutes straight is dedicated to the rolling blackouts in California, images of streetlights not working, powergrids, images of substations.

Former Gov. Gray Davis gets in on the action by saying, “When I ran for governor in 1998 not one human being asked me about electricity.” 1998… was about the time Enron bought P&G and there was not a whisper of controversy? How can that be?

Joseph Dunn, state senator, says that “California was selected by Enron to experiment with this new concept of de-regulated electricity.” California had been deregulated since 1996.

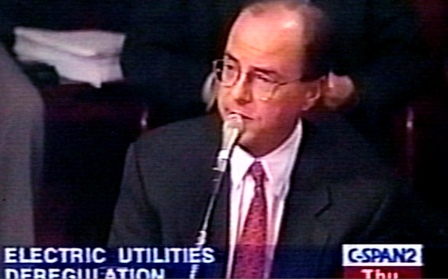

Enron was involved in public debates in mid-1990s, and Jeff among others gave testimony before CA legislature and other such places, about the CA deregulation. Enron became opposed to the “deregulation” to be adopted as it became clear what was going to be adopted, and correctly predicted it would be a disaster, the primary concern being that prices to consumers weren’t to be deregulated. It was during one of the testimonials that this picture was snagged. Skilling is testifying that reducing energy costs is only one benefit from choice and competition. Note the big glasses. This means the conference happened at some point in the past, before things got bad in California, not on the precipice of disaster, as the video tries to imply.

The narrator then goes on to say that inside Enron, California was “little more than a joke”, whatever that means, and that “the joke would be on California.”

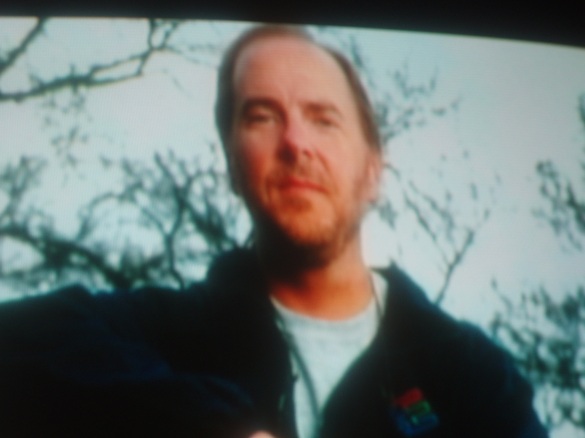

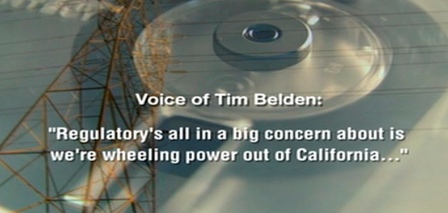

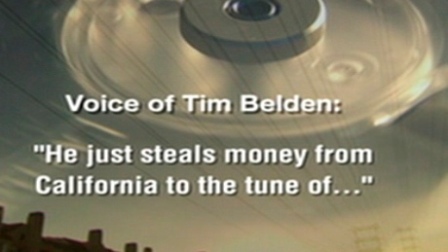

Bethany McLean’s voice comes over again and tells us that Tim Belden was the head of California’s energy desk. “Tim Belden was a believer in free markets,” McLean says (as she said about the traders in Houston, as well), and “he poured over documents about the energy industry looking for loopholes that Enron could exploit to make money.”

How she knows this is again a mystery. It is possible but unlikely that Belden spoke to her in the writing of her book, but she never indicates the source of this statement.

The narrator explains that after the bankruptcy, a memo surfaced which showed the names of some of Belden’s strategies. (Get Shorty, Death Star, Wheel Out, Fat Boy, Ricochet).

It should be noted that during his trial, Jeff called the names ‘unfortunate’. The names flash across the screen, appearing to drip blood, which is creative and might be appropriate if you’re making a specific point about the strategies themselves, but this video is approaching the audience as an objective arbiter of the truth.